JUST THE FACTS

- GLOBAL TIKTOKER JUDGE RECRUITING MISSION ...

MORE FACTS:

- After 4 months of hotel decision-waiting confinement, Pamela Jane Nye’s claim, appeal and her request to meet with the Farmers Insurance CEO were all denied.

- Nye' discovered her former Farmers agent transferred her residence and content fire coverage from Farmers to California Fair Plan (CFP) without her understanding or informed consent.

- When contacted, CFP told Nye to "speak with your Farmers agent (Michael Rey) who was sent copies of payment due, late payment warnings, and cancellation notices."

- Only when questioned did CFP admit it received, kept, and still keeps Nye's $2,942 annual renewal policy.

- September 23, 2025 -- CFP informed Nye, "We conducted a thorough review, and your California FAIR Plan policy terminated October 24, 2025, due to nonpayment of premium. Therefore, we must respectfully deny your claim as there was no policy in force at the time of the loss. As of today your claim is closed. If you have any questions regarding any of the foregoing and/or decision with respect to your claim, or if there is additional information you would like us to consider, please contact the undersigned. - Jessica Mansfield, Claims Examiner III.

- 11/06/2025 --Nye responded to CFP's above invitation with her claim appeal and supportive documents.

- CFP's response to Nye's claim appeal will be posted when received.

COMING SOON:

SUMMARIZED AND EVIDENCE SUPPORTED

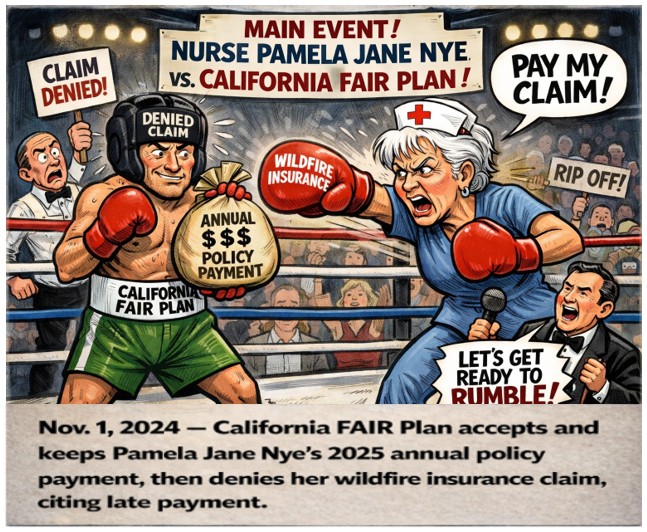

- Bank records confirm that on November 1, 2024 California Fair Plan (CFP) had received and subsequently deposited Nurse Pamela Jane Nye's annual insurance policy renewal check dated October 23, 2024 and for the correct amount of $2,943.

- Bank records confirm there's no evidence Nye received, deposited or cashed any California Fair Plan refund payment.

- CFP admits it kept, continues to keep Nye's $2.934 insurance policy renewal payment.

- 09/22/2025 and 09/23/2025 CFP records confirm receipt and denial of Nye's insurance claim.

- 11/06/2025 CFP's CEO and claims department received copies of Nye's claim appeal and supportive documents.

- CFP CLAIM APPEAL RESPONSE AND REQUESTED EVIDENCE DOCUMENTS FROM CFP UNDERWRITING AND CLAIMS DEPARTMENT.

- DETAILS REGARDING ADDITIONAL CLAIMS AGAINST FARMERS INSURANCE AGENT(S) AND FARMERS INSURANCE GROUP.

- DETAILS ABOUT NYE'S INSURANCE POLICY REFORM LEGISLATION MISSION